Ads

Apply Online Discover how to submit your application via the app.

Learn about the process for applying through the app. Applying for the OpenSky Secured Visa card online is a straightforward procedure. Visit their official website and click on the “Apply Now” button. You’ll need to provide personal information such as your name, address, Social Security number, and employment and income details. OpenSky will evaluate your credit history to determine eligibility. If approved, you’ll be required to make a security deposit to secure the card.

Upon approval, your new OpenSky Secured Visa card will be sent to you and ready for immediate use. Since it’s a secured card, it’s advisable to use it primarily for emergencies or occasional purchases. Responsible usage of this card can contribute to the rebuilding of your credit history and the enhancement of your credit score.

Apply Using the App

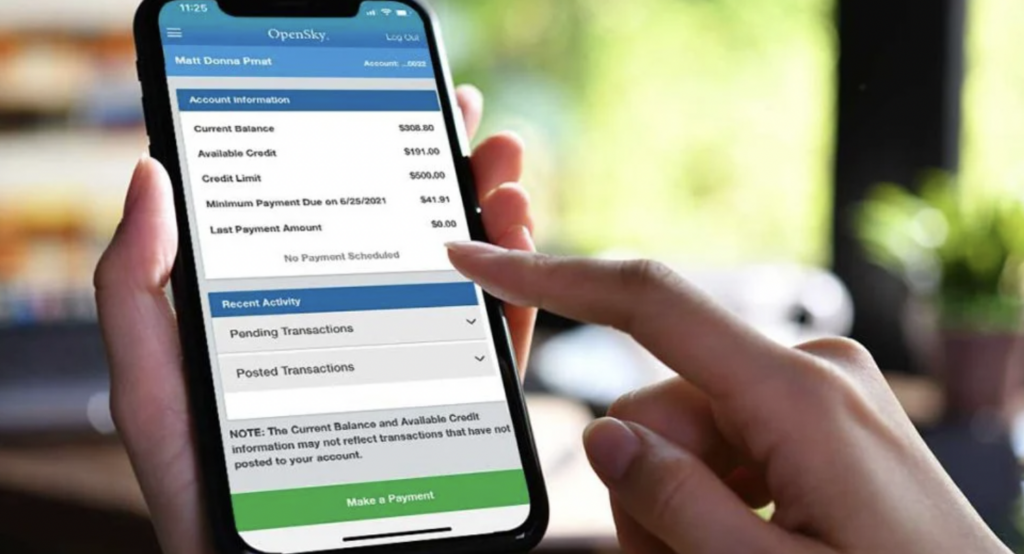

OpenSky offers a mobile app for managing your account, allowing you to review recent transactions, make payments, and check your upcoming payment date and minimum payment due. While card activation is available on their website, the application process itself is not accessible through the app.

Below, you can compare the two cards and use the provided link to apply for the Assent credit card.

OpenSky Secured Visa Credit Card:

- No credit score requirement

- $35 annual fee

- 21.89% regular APR (variable) for purchases and cash advances

- No welcome bonus

- No rewards

Read on to discover how this product could work in your favor.

Credit Score: Bad credit

Annual Fee: $35

Regular APR: 21.89% (variable APR) for Purchases and Cash Advances

Welcome Bonus: None

Rewards: None

OpenSky Secured Visa Credit Card:

To apply for the OpenSky Secured Visa card, you’ll need to make a security deposit, which will determine your credit limit. The card carries a 21.89% (variable) APR, a $35 annual fee, and provides complimentary access to your credit score. It can aid in the repair of your credit by reporting your payment history to all three major credit bureaus.

Despite its benefits, the OpenSky Secured Visa Credit Card has certain limitations. It does not offer rewards for purchases, and late payments can result in a fee of up to $38.

While the OpenSky Secured Visa card is accessible to all, certain requirements must be met, including having a Social Security Number, being a U.S. citizen or resident, and paying a security deposit. The deposit will be refunded upon account closure with no outstanding balance.

Is It Advisable to Consider Getting an OpenSky Secured Visa Credit Card? Is this card worth obtaining? Is it recommended to apply for this card?

The OpenSky Secured Visa card is a sound choice for credit repair. With a low annual fee and complimentary access to your credit score, this card can aid in improving your credit rating by reporting your payment history to all three credit bureaus.

OpenSky offers an instant response without a credit check and the potential for an increased credit line after 6 months without requiring an additional deposit. Additionally, customers can select a due date that aligns with their payroll.

However, the OpenSky Secured Visa card does have some drawbacks to consider. It lacks rewards, and there is a $35 annual fee. Additionally, a security deposit is mandatory when applying for the card.