Ads

Do you wish to build your credit but have been using your debit card instead? Are you having trouble getting a credit card because of a poor credit score?

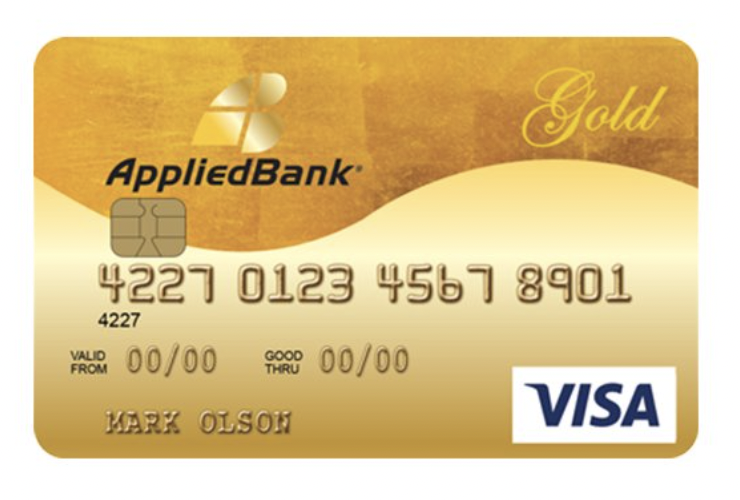

The Applied Bank® Gold Preferred® Secured Visa® Card may be a good option if you answered yes. If your goal is to raise your credit score, this card was made just for you!

Some benefits of having an Applied Bank® Gold Preferred® Secured Visa® card are listed below.

- Offers a low fixed APR of 9.99% and does not examine your credit;

- Refundable security deposit;

- Credit bureau reporting provided.

Can you tell me about the benefits of having a Gold Preferred Secured Visa from Applied Bank?

Many credit cards, including the Applied Bank® Gold Preferred® Secured Visa® Card, offer similar perks for developing credit. This card has a fixed APR of 9.99%, which is very low compared to other credit-building cards’ variable APRs.

How safe is it to use my Gold Preferred Secured Visa® Card from Applied Bank?

Absolutely! The Applied Bank® Gold Preferred® Secured Visa® Card is a safe and convenient way to build or repair your credit while also providing access to competitive low fixed APRs.

Does the Applied Bank® Gold Preferred® Secured Visa® Card have the potential to help my credit?

On the last day of every month (the closing statement date), information on customers’ Applied Bank® Gold Preferred® Secured Visa® Card accounts is sent to Equifax, Experian, and TransUnion. Making payments on time and keeping your credit card balances low are two proven ways to raise your credit score.

If you don’t qualify for the Applied Bank® Gold Preferred® Secured Visa® Card but still want to develop credit, you may want to look into the OpenSky Secured Visa Card. Keep reading to learn more about this card and the application process.

It’s important to have a credit card that works for your lifestyle if you want to build or repair your credit. If you want to establish or enhance your credit history, the Applied Bank® Gold Preferred® Secured Visa® Credit Card is a great choice.

With its low fixed interest rate and affordable annual fee, it’s a great tool for getting your finances in order. Find out how this card can help you build a stronger financial foundation for the future by reading our review.

You may start again financially by applying for a Gold Preferred Secured Visa Card from Applied Bank.

What is the procedure for applying for a Gold Preferred Secured Visa Credit Card from Applied Bank?

As a secured credit card, the Gold Preferred® Secured Visa® Credit Card requires an opening deposit equivalent to the credit line. Applied Bank has a minimum deposit of $200, but you can spend as much as $1,000 right away. If more money is allocated, we can eventually raise that cap to $5,000.

In exchange for a $48 annual fee, cardholders of the Applied Bank® Gold Preferred® Secured Visa® Credit Card enjoy a variable APR of 9.99%. People with limited or no credit history may find it useful because it does not require a credit check and submits all payments to credit bureaus, increasing the likelihood of approval.